ZIMRA Tax Forms Hub for Zimbabwean Businesses

Instant Downloads | Step-by-Step Filing Guides | Always Updated

Why Using the Right Forms Matters

RBZ compliance ensures financial institutions and businesses adhere to regulatory standards, safeguarding Zimbabwe’s financial stability and preventing illicit activities like money laundering. Failing to meet these requirements can result in severe penalties, reputational damage, and loss of investor confidence, undermining economic growth.

Stat Box: ⚠️ “62% of ZIMRA rejections are due to outdated or incorrect forms”

Complete ZIMRA Forms Library

A. Income Tax Forms

B. VAT Forms

| Form | Purpose | Download |

| ITF12C | Annual Corporate Tax Return | Download PDF |

| ITF12B | Quarterly Provisional Tax (QPD) | Download PDF |

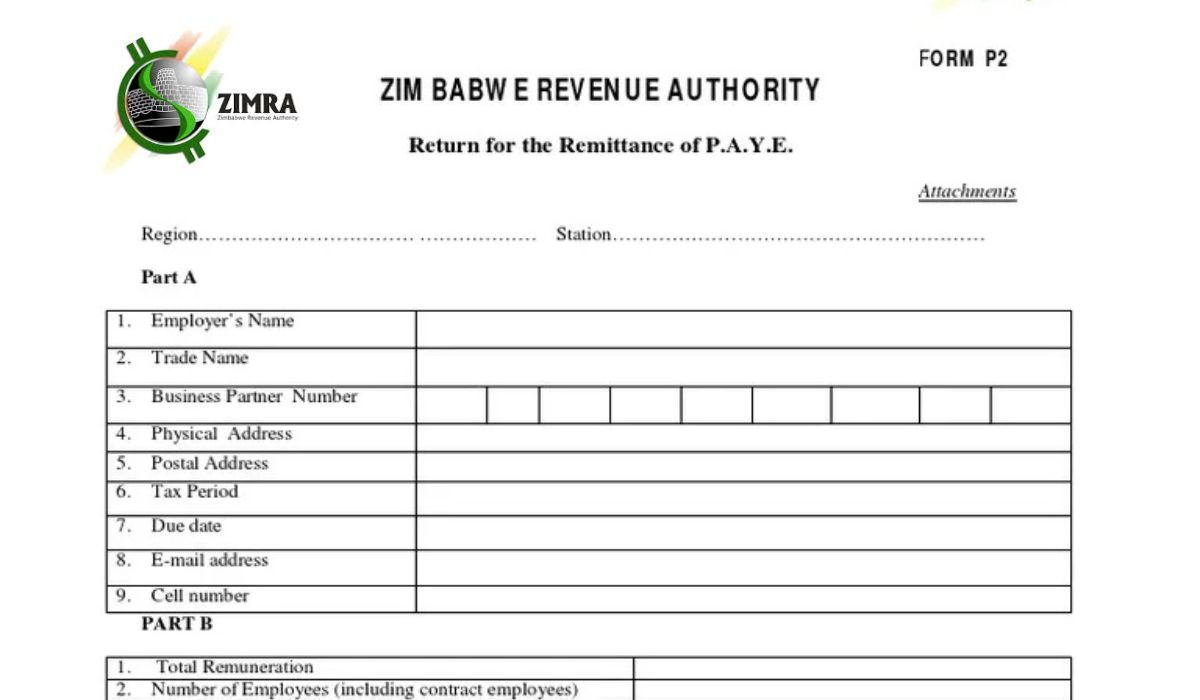

| ITF16 | Monthly PAYE Return | Download PDF |

Pro Tip: “Always use the latest ITF12C version – old forms rejected after 1 Jan 2024”

B. VAT Forms

| Form | Purpose | Download |

| VAT1 | VAT Registration | Download PDF |

| VAT7 | Monthly VAT Return | Download PDF |

| VAT10 | VAT Deregistration | Download PDF |

Critical Note: “VAT7 now requires Ecocash transaction details”

Withholding Tax Forms

| Form | Purpose | Download |

| WT1 | Non-Resident Tax | Download PDF |

| WT2 | Resident Withholding Tax | Download PDF |

Special Sector Forms

Mining:

- M1: Mineral Royalty Return Download

Tourism:

- TAZ1: Tourism Levy Download

NGOs:

- NGO3: Tax Exemption Application Download

Form Update Tracker

Latest Changes:

- 1 May 2025: New ITF12C fields for forex transactions

- 15 April 2025: Revised WT1 thresholds

- 1 March 2025: Updated VAT1 supporting documents list

Subscribe to get automatic update notifications

FAQs:

Premium Services

Need More Help?

- Form Filling Service: From $50/form

- eFiling Assistance: $30/month

- Emergency Submission: Same-day service available