Payroll Processing – Accurate PAYE, NSSA & NEC Calculations Every Month

Avoid Costly ZIMRA Penalties with Fully Compliant Payroll – Whether Paying in ZWG, USD, or Hybrid

Why Accurate Payroll Matters in Zimbabwe

Zimbabwe’s complex labor laws, multi-currency payments, and frequent tax changes make payroll a minefield. One mistake can trigger ZIMRA audits or employee disputes

Key Risks of Poor Payroll Management:

- ✔ ZIMRA Penalties – Late PAYE filings attract 10% fines + interest.

- ✔ NSSA/NEC Shortfalls – Underpaid contributions risk business blacklisting.

- ✔ Employee Distrust – Incorrect ZWG/USD splits cause salary disputes.

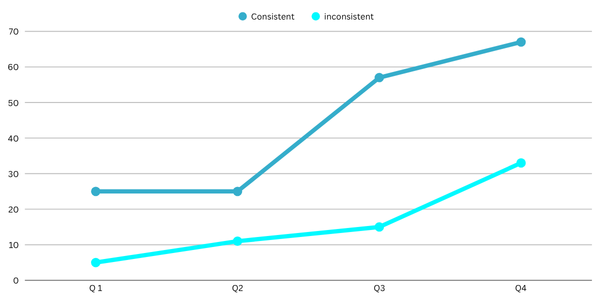

ZIMRA Payroll Focus In 2024

67% of ZIMRA payroll audits in 2023 targeted businesses with inconsistent PAYE records.

Our Payroll Services

A. Salary Processing (ZWG, USD, or Hybrid)

What We Do:

- Calculate gross-to-net pay in compliance with ZIMRA’s latest tax bands.

- Handle multi-currency payrolls (e.g., part-USD, part-ZWG salaries).

Zimbabwe-Specific Features:

- Parallel vs. Official Rate Adjustments (for businesses using market rates).

- Payslip Annotations – Clearly show USD/ZWG equivalents (critical for employee transparency).

Sample Payslip

| Earnings | USD | ZWG (Official Rate) |

| Basic Salary | $300 | ZWG 9,600 |

| Bonus | $50 | ZWG 1,600 |

| Total Gross | $350 | ZWG 11,200 |

B. Statutory Deductions (PAYE, NSSA, NEC, Aids Levy)

What We Cover:

Warning Note: NSSA now requires monthly electronic submissions – manual filings risk penalties.

C. ZIMRA Reporting & Compliance

What We File For You:

- Monthly PAYE Returns (ITF16) – Submitted via ZIMRA eFiling.

- Annual Tax Certificates (ITF12C) – For all employees.

- RBZ Forex Approvals – If paying salaries in USD (Form CD1).

How It Works (4-Step Process)

Pricing (Transparent & All-Inclusive)

| Service | Best For | Price (USD) |

| Basic Payroll (1-10 Employees) | Small businesses | $50/month |

| Forex Payroll (USD/ZWG Hybrid) | Exporters, NGOs | $120/month |

| Full Compliance Package | Large teams (+20 staff) | Custom Quote |

Prices include monthly ZIMRA/NSSA filings. NSSA penalties coverage is optional.

Client Testimonial

“After ZIMRA fined us $2,000 for incorrect PAYE, we switched to Mukanya’s payroll service. Now, everything is filed perfectly – and our staff trust their payslips!”

— Manufacturing Co., Harare