Stress-Free Corporate Tax Compliance – Avoid ZIMRA Penalties

Expert Handling of QPDs, Provisional Tax, and ZIMRA Audits– In ZWL, USD, or Both

Why Corporate Tax Compliance is Critical in Zimbabwe

Zimbabwe’s complex tax environment – with frequent ZIMRA regulation changes, forex fluctuations, and strict QPD requirements – makes corporate tax filing a high-risk process

Key Risks of Poor Tax Management:

- ✔ ZIMRA Penalties – Up to 100% fines for late/inaccurate submissions.

- ✔ Cash Flow Disruptions – Underestimated QPDs lead to unexpected tax bills.

- ✔ Audit Triggers – Inconsistent filings increase audit risk by 73% (ZIMRA 2023).

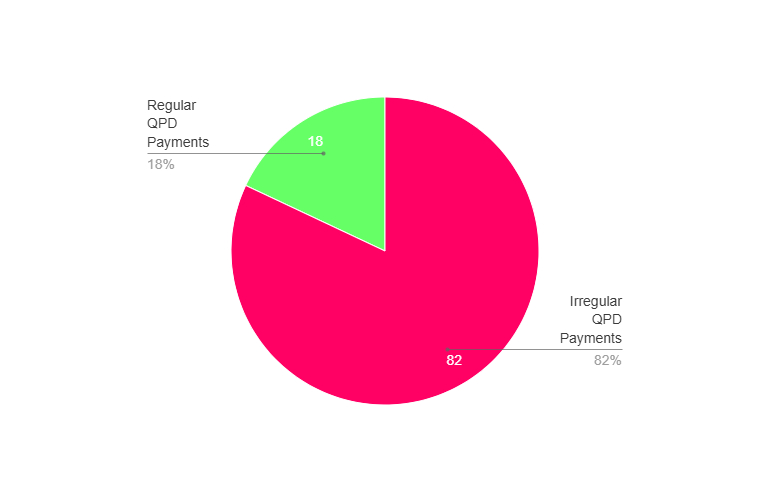

82% of ZIMRA corporate tax audits in Q1 2024 targeted businesses with irregular QPD payments

Our Corporate Tax Services

A. Quarterly Payment Dates (QPDs) Management

What We Do:

- Calculate accurate quarterly tax estimates per ZIMRA rules.

- File Form ITF 12.B and ensure timely payments.

Zimbabwe-Specific Features:

- Forex Adjustment Guidance – Handling USD-denominated taxes in ZWG.

- Payment Reminders – Avoid 10% late payment penalties.

🗓️ 2025 QPD Calendar Snippet:

| Quarter | Deadline | Penalty for Late Payment |

| Q1 | 25 March | 10% + interest |

| Q2 | 25 June | 10% + interest |

B. Annual Corporate Tax Return (ITF12C)

What We Cover:

Warning Note: ZIMRA now requires electronic submissions – paper filings face automatic penalties.

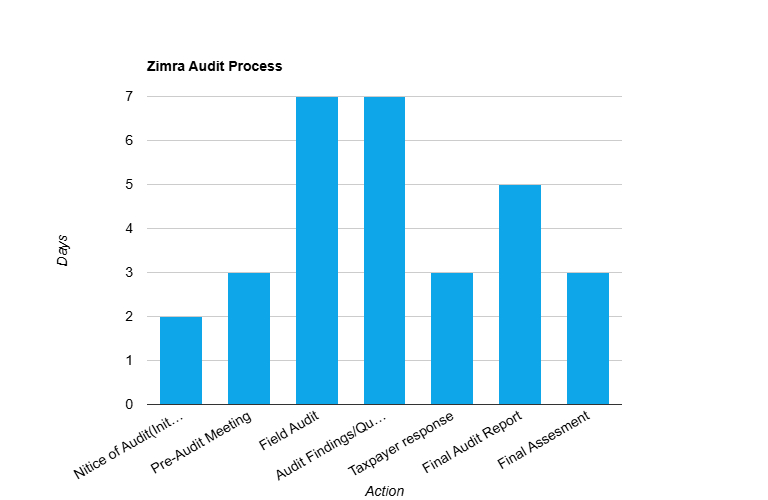

C. ZIMRA Audit Support

What We Provide:

- Pre-audit health checks – Identify red flags.

- Representation – Handle ZIMRA queries on your behalf.

- Dispute Resolution – Objection letters, appeals.

ZIMRA audit process (From Notice → Final Assessment)

How It Works (4-Step Process)

Pricing (Transparent packages)

| Service | Best For | Price (USD) |

| Basic QPD Management | Small businesses | $75/quarter |

| Full Corporate Tax Filing | Medium enterprises | $1,200/year |

| Audit Defense Package | High-risk industries | Custom Quote |

Client Testimonial

“After ZIMRA hit us with $8,000 in back taxes, Mukanya Financial Services team corrected our QPDs and got our compliance back on track!”

— Mining Supplier, Bulawayo